What is Insurer ID and Why It's Important: The Ultimate Guide

1. What is an Insurer ID?

Definition of an Insurer ID

An Insurer ID, also known as an Insurance Identification Number, is a unique alphanumeric code assigned to an insurance company or provider. This ID is used to identify and differentiate insurance companies within a specific market or jurisdiction. It serves as a crucial identifier for various purposes, such as filing insurance claims, verifying coverage, and facilitating communication between the insurer and policyholders.

Importance of an Insurer ID

The Insurer ID plays a vital role in the insurance industry, ensuring seamless operations and effective information management. With this ID, insurance companies can accurately track and report their activities, allowing regulatory authorities to monitor the industry and enforce compliance. Additionally, the Insurer ID helps policyholders and healthcare providers quickly identify the insurer associated with a specific policy, enabling them to streamline administrative processes and access necessary coverage details.

Usage of an Insurer ID

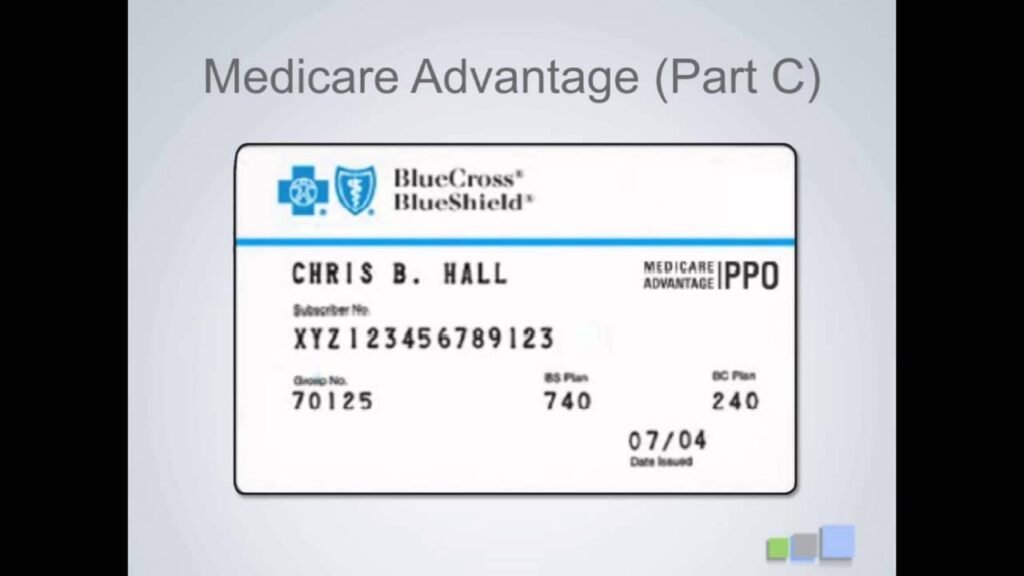

Insurance companies typically incorporate their unique Insurer ID on various documents, including insurance cards, claim forms, and policy documents. This ID acts as a reference point for policyholders when interacting with their insurers. Additionally, healthcare providers use the Insurer ID to confirm coverage eligibility and process claims, ensuring accurate billing and reimbursement. It is important for policyholders to familiarize themselves with their insurance company's Insurer ID and understand how to utilize it appropriately in their healthcare interactions.

Conclusion

Understanding the concept and purpose of an Insurer ID is crucial for both insurance companies and policyholders. This unique identifier serves as a link between insurers, policyholders, and healthcare providers, facilitating efficient communication and administrative processes. By ensuring accurate and consistent usage of the Insurer ID, all parties involved can benefit from smoother operations and improved access to insurance services.

2. Importance of Insurer ID

Obtaining an Insurer ID is of vital importance for both insurance companies and policyholders. The Insurer ID serves as a unique identifier for insurance providers, allowing for easier tracking and identification across various systems and databases.

For insurance companies, having an Insurer ID is essential for regulatory compliance. It enables them to be properly recognized and licensed by governmental bodies, ensuring that they meet the legal requirements to operate in their respective jurisdictions. Additionally, the Insurer ID allows insurance companies to establish credibility and trust with policyholders, as it serves as proof of their legitimacy and financial stability.

Policyholders also benefit greatly from the Insurer ID. It ensures that they are dealing with a reputable insurance company and not falling victim to fraudulent practices or scams. By verifying the Insurer ID, policyholders can easily confirm the authenticity and reliability of the insurance provider, giving them peace of mind knowing that they are protected by a trusted entity.

Furthermore, the Insurer ID facilitates efficient communication and coordination between insurance companies, policyholders, and regulatory bodies. It streamlines administrative processes, such as claims processing and policy management, by eliminating confusion and minimizing errors. This, in turn, results in quicker response times and a smoother experience for all parties involved.

3. How to Find Your Insurer ID?

[aib_post_related url='https://towla24.com/does-medicare-pay-for-cataracts/' title='Does Medicare Cover Cataract Surgery? Exploring the Benefits' relatedtext='You may also be interested in:']When it comes to managing your insurance, it's crucial to have your insurer ID readily available. Your insurer ID is a unique identifying number that helps insurance companies keep track of your policy and important information related to it. Whether you're applying for a new policy, making a claim, or simply need to provide your insurer ID for verification purposes, knowing how to find it is essential.

One of the easiest ways to find your insurer ID is by referring to your insurance card. Most insurance companies provide their policyholders with a physical or digital insurance card that contains all the necessary information, including the insurer ID. Look for a series of numbers or a combination of letters and numbers that specifically identify your policy. It's important to keep your insurance card handy, as it's often required for medical appointments, filing claims, or contacting your insurance provider.

If you can't find your insurer ID on your insurance card, another option is to reach out to your insurance company directly. They should be able to provide you with the necessary information and guide you through the process. Make sure to have your policy details and personal information readily available when contacting your insurance provider. They may ask for additional verification to ensure you are the policyholder.

Lastly, if you have an online account with your insurance company, log in and navigate to the policy details section. Here, you should be able to find your insurer ID along with other relevant information about your policy. The online account is a convenient way to access your policy information and make updates whenever necessary.

4. Understanding the Components of Insurer ID

[aib_post_related url='https://towla24.com/how-do-i-get-the-lowest-quote-on-my-insurance/' title='Unlock the Secrets: How to Score the Lowest Quote on Your Insurance Today' relatedtext='You may also be interested in:']The Significance of Insurer ID

Insurer ID, also known as Insurance ID or Insurance Provider Identifier, is a unique identification number assigned to insurance companies. This number plays a vital role in the healthcare industry as it helps streamline administrative processes and ensures accurate billing and claims management. Understanding the components of Insurer ID is crucial for healthcare providers, patients, and insurance companies to ensure smooth operations.

Components of Insurer ID

Insurer IDs typically consist of specific components that provide essential information about the insurance company. These components may vary depending on the country's regulations. However, in general, an Insurer ID comprises the following elements:

1. National Provider Identifier (NPI): This is a unique 10-digit number assigned to healthcare providers and organizations by the Centers for Medicare and Medicaid Services (CMS) in the United States. It helps identify the insurance providers accurately.

2. Plan ID: This component represents the specific insurance plan offered by an insurer. It helps differentiate between various coverage options provided by the same insurance company.

3. Regional Code: Some countries utilize regional codes as part of the Insurer ID structure. These codes indicate the geographical area where the insurance company operates.

4. Checksum Digit: The checksum digit is a mathematical algorithm used to verify the accuracy of the Insurer ID. It ensures that the ID has been entered correctly and helps prevent errors in claims processing.

Importance of Understanding Insurer ID

For healthcare providers, having a clear understanding of the components within the Insurer ID is crucial for accurate claims submission and reimbursement. By correctly identifying the insurance provider and the specific insurance plan, healthcare facilities can ensure that claims are processed smoothly and payments are received in a timely manner.

Patients also benefit from understanding the Insurer ID as it allows them to verify the coverage provided by their insurance plan. It helps avoid confusion and surprises when seeking medical services, ensuring they are aware of any potential limitations or exclusions.

Overall, comprehending the components of Insurer ID is essential for all parties involved in the healthcare ecosystem. It facilitates efficient communication, data exchange, and coordination between healthcare providers and insurance companies, ensuring a seamless experience for everyone involved in the healthcare journey.

5. Frequently Asked Questions about Insurer ID

Are you confused about what an Insurer ID is and how it works? In this section, we answer the most common questions regarding Insurer IDs to help you gain a better understanding.

What is an Insurer ID?

[aib_post_related url='https://towla24.com/what-are-the-4-types-of-auto-insurance/' title='Discover the 4 Essential Types of Auto Insurance You Need to Know About' relatedtext='You may also be interested in:']An Insurer ID, also known as an Insurance Identification Number, is a unique identifier assigned to insurance companies by regulatory bodies. It is used to identify and track insurance providers, allowing for efficient record-keeping and regulatory compliance.

Why do I need an Insurer ID?

If you are an insurance provider, having an Insurer ID is essential in order to legally operate and provide insurance services. It is a requirement enforced by regulatory agencies to ensure transparency, accountability, and consumer protection within the insurance industry.

How can I obtain an Insurer ID?

The process of obtaining an Insurer ID may vary depending on the country and regulatory requirements. Generally, you would need to submit an application to the relevant regulatory body, providing necessary documentation such as proof of registration, financial information, and compliance with insurance regulations. It is advisable to consult with your local regulatory agency or seek professional assistance to ensure a smooth application process.

By familiarizing yourself with the concept of an Insurer ID and its significance, you can ensure compliance with regulatory requirements and maintain a reputable standing within the insurance industry.

👆👆botón siguiente para ver todo el contenido👆👆

- Unlocking Opportunities: How to Easily Obtain a US Insurance License

- Demystifying Insurance Cards in the USA: All You Need to Know

Why Is Surgery So Expensive in the US: Unraveling the Healthcare Cost Mystery

Uncovering the Country with the Highest Medical Bills: A Comprehensive Analysis

Unveiling the Country with the Most Expensive Medical Bills: A Surprising Discovery

What Is the Highest Medical Bill Ever? Exploring Extreme Health Care Costs

The World's Most Expensive Hospital: A Look Inside Healthcare's High-Cost Facilities

The Most Expensive Sickness to Treat: Exploring Healthcare Costs

¡Compartir para desbloquear el contenido!!

Funcional Always active

Preferencias

Estadísticas

Marketing

Leave a Reply