What is Credit Card Balance Insurance and How Does it Work?

Understanding the Importance of Credit Card Balance Insurance

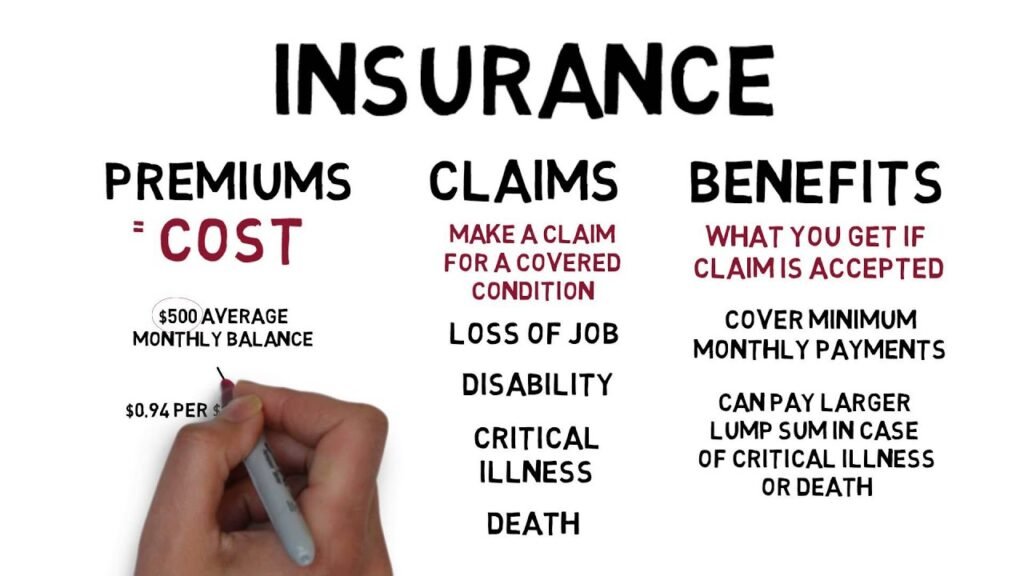

Credit card balance insurance is a crucial aspect of financial planning that often gets overlooked. This type of insurance is designed to protect individuals from unexpected events that may render them unable to make their credit card payments.

Having credit card balance insurance ensures that cardholders are protected in the event of job loss, disability, illness, or death. By covering their outstanding credit card debt, it provides a safety net that prevents individuals from falling into a financial crisis.

One of the main reasons why credit card balance insurance is important is the potential impact on credit scores. Failing to make credit card payments can result in significant damage to one's credit history. However, with the insurance coverage, individuals can avoid this negative consequence and maintain a good credit score.

Furthermore, credit card balance insurance provides peace of mind and financial stability, allowing individuals to focus on their recovery or reestablish their income without the added stress of mounting credit card debt. It acts as a financial safety net, providing a sense of security during difficult times.

Exploring the Benefits of Insurance for Credit Card Balance

Credit card balance insurance is a type of coverage that offers protection for consumers who are unable to repay their credit card debts due to unexpected circumstances, such as job loss, disability, or death. This insurance can provide peace of mind by ensuring that the outstanding balance on a credit card is taken care of during difficult times.

One of the main benefits of credit card balance insurance is that it helps prevent the accumulation of high-interest debt. If a policyholder becomes unable to make the minimum monthly payments on their credit card, the insurance coverage will step in and cover the outstanding balance, preventing it from growing and causing further financial strain.

In addition to reducing debt, credit card balance insurance also offers protection against unexpected events. For example, if a policyholder were to become disabled and unable to work, they may struggle to make any payments towards their credit card. The insurance would provide a safety net by covering the outstanding balance, relieving the policyholder from financial stress during their recovery.

Furthermore, credit card balance insurance can also be beneficial in the unfortunate event of a policyholder's death. If the policyholder passes away before fully repaying their credit card debt, the insurance coverage would ensure that the outstanding balance is taken care of, sparing their loved ones from potentially inheriting a significant financial burden.

Why You Need to Consider Credit Card Balance Insurance

Protect Yourself from Unexpected Events

Life is filled with uncertainties, and unexpected events can often throw our financial plans off track. One such event that can significantly impact your financial well-being is an illness, disability, or job loss. In such situations, credit card balance insurance can provide you with the much-needed safety net.

Ensure Peace of Mind

Carrying a large credit card balance can be a stressful experience, especially if you are unable to make your payments due to unforeseen circumstances. By considering credit card balance insurance, you can protect yourself from falling behind on payments and accruing excessive interest charges. This insurance provides you with the peace of mind that, even during challenging times, your minimum payments will be covered.

Stay on Track to Achieve Your Financial Goals

Having a significant credit card balance can hinder your ability to reach your long-term financial goals, such as buying a home, starting a family, or going on that dream vacation. By opting for credit card balance insurance, you can ensure that unforeseen circumstances don't derail your progress. With the assurance that your minimum payments will be covered, you can focus on staying on track towards achieving your financial aspirations.

It's vital to consider credit card balance insurance if you want to protect yourself from unexpected events, ensure peace of mind, and continue working towards your financial goals. The small cost of this insurance can save you from financial distress in difficult times and help you maintain control over your credit card debt.

Protecting Your Finances: All About Credit Card Balance Insurance

When it comes to managing your finances, it's important to have a solid understanding of credit card balance insurance. This type of insurance can provide you with protection in the event that you are unable to make your credit card payments due to unexpected circumstances.

Credit card balance insurance acts as a safety net, helping to cover your outstanding credit card balance if you become disabled, lose your job, or experience a serious illness. It can provide you with peace of mind knowing that you won't be burdened with hefty credit card bills during a difficult time.

One key benefit of credit card balance insurance is its ability to protect your credit score. By making timely payments, you can maintain a good credit rating. But unforeseen events can disrupt your ability to pay off your credit card balance, potentially damaging your credit. With credit card balance insurance, you can mitigate this risk and safeguard your financial standing.

To take advantage of the benefits of credit card balance insurance, it's important to carefully review the terms and conditions of your policy. Understand the coverage limits, exclusions, and any waiting periods that may apply. By doing so, you can make an informed decision and select a policy that suits your needs.

Unveiling the Secrets of Credit Card Balance Insurance

[aib_post_related url='https://towla24.com/is-aarp-the-same-as-medicare/' title='AARP vs Medicare: Understanding the Differences' relatedtext='You may also be interested in:']Are you familiar with credit card balance insurance? If not, don't worry, you're not alone. Many credit cardholders are unaware of this type of insurance and the benefits it can provide. In this article, we will unveil the secrets of credit card balance insurance.

Credit card balance insurance is a type of coverage that protects cardholders in the event of unforeseen circumstances that prevent them from making their credit card payments. These circumstances may include job loss, disability, or even death. With credit card balance insurance, cardholders can have peace of mind knowing that their outstanding balances will be taken care of in these situations.

Many people tend to overlook credit card balance insurance, thinking that they would never need it. However, life is unpredictable, and unexpected events can occur at any time. Having credit card balance insurance can be a safety net during challenging times, ensuring that you don't fall into a cycle of debt.

[aib_post_related url='https://towla24.com/does-baby-go-on-mom-or-dads-insurance-3/' title='Who Should Baby be Insured Under - Mom or Dad's Insurance' relatedtext='You may also be interested in:']So, how does credit card balance insurance work? Typically, cardholders pay a small monthly premium for this type of coverage. If they are unable to make their credit card payments due to a covered event, the insurance company will step in and pay the outstanding balance on their behalf. This can provide cardholders with much-needed financial relief during difficult times.

👆👆botón siguiente para ver todo el contenido👆👆

- Understanding Credit Insurance: Who Needs it and Why it's Essential

- Your Ultimate Guide on How to Claim Debit Card Insurance

Why Is Surgery So Expensive in the US: Unraveling the Healthcare Cost Mystery

Uncovering the Country with the Highest Medical Bills: A Comprehensive Analysis

Unveiling the Country with the Most Expensive Medical Bills: A Surprising Discovery

What Is the Highest Medical Bill Ever? Exploring Extreme Health Care Costs

The World's Most Expensive Hospital: A Look Inside Healthcare's High-Cost Facilities

The Most Expensive Sickness to Treat: Exploring Healthcare Costs

¡Compartir para desbloquear el contenido!!

Funcional Always active

Preferencias

Estadísticas

Marketing

Leave a Reply