- Towla 24

- CRYPTOCURRENCY

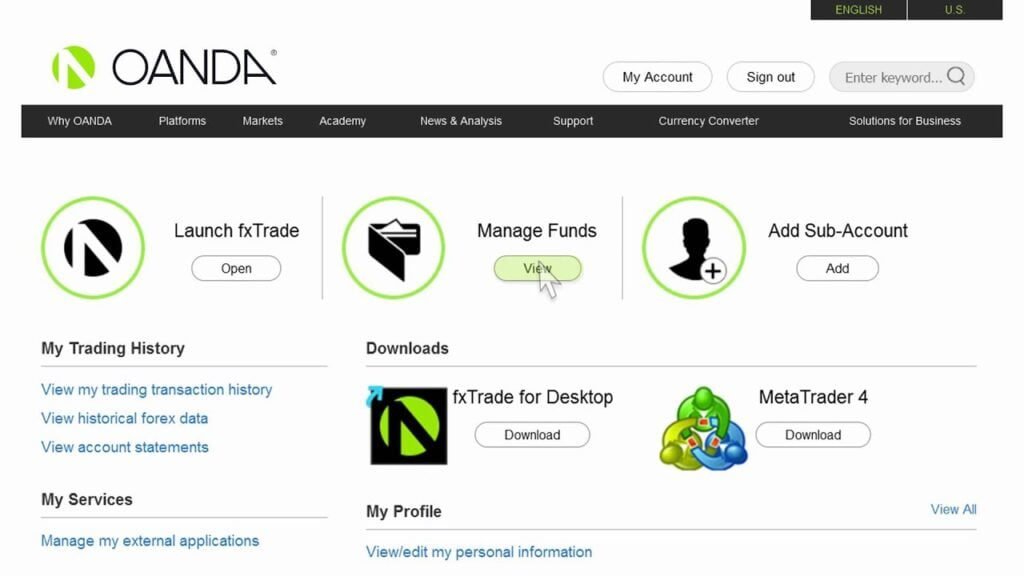

- OANDA Leverage: Exploring Your Trading Potential

OANDA Leverage: Exploring Your Trading Potential

How much leverage does OANDA give you?

If you are interested in trading in the foreign exchange market, you may have wondered how much leverage OANDA, one of the most popular online forex brokers, offers to its clients. Leverage is a loan that a broker gives you to allow you to trade with a larger position than you would be able to with your own funds. It can be a useful tool for traders to take advantage of small price movements, but it also increases the potential for losses.

What is leverage

Leverage is expressed as a ratio, such as 50:1 or 100:1, which means that for every dollar you have in your trading account, you can borrow 50 or 100 dollars from the broker to trade with. This can magnify both gains and losses, so it is important to use it judiciously and to understand the risks involved.

OANDA's leverage

OANDA offers a maximum leverage of 50:1 for major currency pairs, and lower ratios for other pairs and commodities. This means that if you have $1,000 in your account, you can trade up to $50,000 worth of currency. Keep in mind, however, that leverage can work against you, so you should only invest what you can afford to lose.

The benefits of leverage

The main benefit of leverage is that it allows you to make larger trades with a smaller amount of capital, which can increase your potential profits. For example, if you have $1,000 and want to trade the EUR/USD pair, which is currently trading at 1.1000, you could buy 1,000 euros, or use leverage to buy 50,000 euros. If the price goes up by 1%, you would make $100 on the first trade but $500 on the leveraged trade.

The risks of leverage

The downside of leverage is that it can also magnify your losses. If the price goes against you, your losses will be multiplied by the same ratio as your gains. Using the example above, if the price of the EUR/USD pair goes down by 1%, you would lose $100 on the first trade but $500 on the leveraged trade.

Conclusion

Leverage can be a powerful tool in forex trading, but it is important to use it responsibly and to understand the risks involved. OANDA offers a maximum leverage of 50:1, which can amplify your returns but also your losses. As with any investment, it is important to do your research and to only invest what you can afford to lose.

- Key takeaway 1: Leverage is a loan from a broker that allows you to trade with a larger position than you would be able to with your own funds.

- Key takeaway 2: OANDA offers a maximum leverage of 50:1 for major currency pairs.

- Key takeaway 3: Leverage can increase your potential profits, but also your losses.

- Key takeaway 4: Always invest responsibly and only what you can afford to lose.

👆👆botón siguiente para ver todo el contenido👆👆

Is Crypto High Risk? Exploring the Potential Risks and Rewards in the Cryptocurrency World

Exploring Alternative Investments: Discovering Options that Outshine Crypto

What Will Bitcoin's Value Be in 10 Years? Predicting the Future of Cryptocurrency

Discover the Answer: How Many Bitcoins are Left?

Predicting the Top Bitcoin that Will Boom in 2023: A Definitive Guide

The Ultimate Guide: Exploring the Top 3 Largest Cryptocurrencies You Need to Know

- Towla 24

- CRYPTOCURRENCY

- OANDA Leverage: Exploring Your Trading Potential

¡Compartir para desbloquear el contenido!!

Funcional Always active

Preferencias

Estadísticas

Marketing

Leave a Reply