Understanding Insurance Deductibles: Do You Pay 100% of Expenses After Meeting Your Deductible?

Do you pay 100% after deductible?

In the world of insurance, deductibles are a common concept that many people come across. But what exactly is a deductible and how does it affect your out-of-pocket expenses? More importantly, do you end up paying 100% of the costs after reaching your deductible? In this article, we will delve deeper into this topic and provide you with a comprehensive understanding of how deductibles work.

What is a deductible?

A deductible is the amount of money that you are responsible for paying before your insurance coverage kicks in. It is a fixed dollar amount determined by your insurance plan. When you encounter medical expenses or file an insurance claim, you will need to pay the deductible out of your own pocket before your insurance company starts covering the costs. The purpose of a deductible is to share the financial burden between the policyholder and the insurance provider.

How does a deductible affect your expenses?

When it comes to insurance coverage, it is important to understand that the deductible is not the only cost you will incur. There may be other costs such as copayments, coinsurance, and non-covered services. However, the deductible is a significant factor that affects your out-of-pocket expenses.

Let's say you have a $1,000 deductible on your health insurance plan. This means that you will need to pay the first $1,000 of covered medical expenses before your insurance starts covering the costs. Once you reach your deductible, your insurance coverage will kick in, and you will only be responsible for copayments or coinsurance, if applicable.

Do you pay 100% after reaching the deductible?

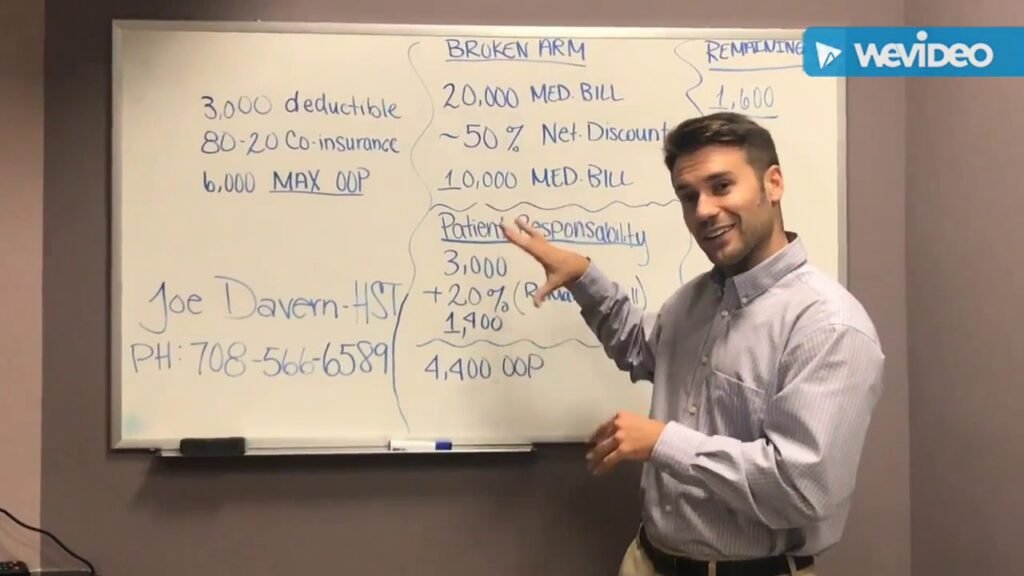

No, reaching your deductible does not mean you will pay 100% of the costs. It depends on the terms of your insurance plan. After you meet your deductible, your health insurance will typically cover a certain percentage of the costs, while you will be responsible for the remaining percentage. This is called coinsurance.

For example, if your insurance plan has 80/20 coinsurance, your insurance will cover 80% of the remaining costs, and you will be responsible for the remaining 20%. This continues until you reach your out-of-pocket maximum, which is the maximum amount you will have to pay during a certain time period before your insurance covers 100% of the costs.

Importance of understanding your insurance plan

It is crucial to carefully review and understand the details of your insurance plan, including the deductible, coinsurance, copayments, and out-of-pocket maximum. Knowing these terms and how they affect your expenses will enable you to make informed decisions and manage your finances better.

It is also important to note that different insurance plans have different deductible structures. Some plans have separate deductibles for certain services or medications, while others have one overall deductible. Make sure to read the fine print and ask questions to your insurance provider to fully understand your coverage.

Conclusion

In summary, a deductible is the amount of money you must pay out-of-pocket before your insurance coverage kicks in. Reaching your deductible does not mean you will pay 100% of the costs. Instead, you will be responsible for coinsurance or copayments, depending on your insurance plan. Understanding your insurance terms and costs is essential in managing your healthcare expenses effectively.

👆👆botón siguiente para ver todo el contenido👆👆

- Discover the Optimal Number of Insurance Claims: How Many is Too Many?

- Comparing the Benefits: Is a $500 Deductible or $250 Deductible a Better Choice?

Why Is Surgery So Expensive in the US: Unraveling the Healthcare Cost Mystery

Uncovering the Country with the Highest Medical Bills: A Comprehensive Analysis

Unveiling the Country with the Most Expensive Medical Bills: A Surprising Discovery

What Is the Highest Medical Bill Ever? Exploring Extreme Health Care Costs

The World's Most Expensive Hospital: A Look Inside Healthcare's High-Cost Facilities

The Most Expensive Sickness to Treat: Exploring Healthcare Costs

¡Compartir para desbloquear el contenido!!

Funcional Always active

Preferencias

Estadísticas

Marketing

Leave a Reply