Everything You Need to Know About Card Protection Insurance: Do I Really Need It?

Why You May Not Need Card Protection Insurance

The Risks of Card Protection Insurance

Card protection insurance is a type of coverage that promises to protect you in case your credit or debit card is lost, stolen, or used fraudulently. While it may seem like a great idea to safeguard your financial security, there are several reasons why you may not actually need this form of insurance.

Firstly, most credit and debit card issuers already provide a certain level of protection against unauthorized transactions. These issuers typically have fraud protection policies in place, which means you are not liable for fraudulent charges made on your card. Therefore, paying an additional premium for card protection insurance may be unnecessary.

Secondly, the coverage offered by card protection insurance may overlap with other existing insurance policies you already have. For example, if you already have rental insurance, it likely covers the loss or theft of personal belongings, which may include your credit or debit cards. It's important to review your existing insurance coverage before considering card protection insurance to avoid paying for duplicate coverage.

[aib_post_related url='https://towla24.com/what-car-brands-are-more-expensive-to-insure/' title='Top 10 Car Brands That Cost a Fortune to Insure: Are You Paying Too Much?' relatedtext='You may also be interested in:']

The Hidden Costs of Card Protection Insurance

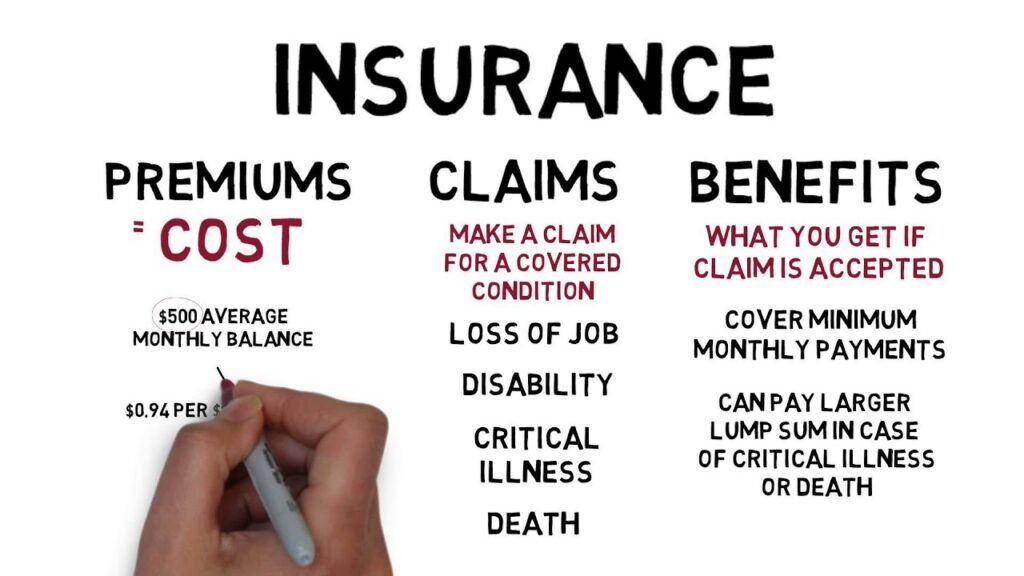

Card protection insurance, also known as payment protection insurance (PPI), is a financial product that promises to cover your credit card payments in case of unexpected events, such as unemployment or illness. While this type of insurance may seem like a smart choice to protect your finances, there are hidden costs that consumers should be aware of.

One of the main hidden costs of card protection insurance is the high premiums charged by insurance providers. These premiums can often be expensive and may not offer adequate coverage for the policyholder. Additionally, many insurance providers include exclusions and limitations in their policies, which further reduce the benefits received.

[aib_post_related url='https://towla24.com/what-is-the-best-resource-to-understand-medicare/' title='Mastering Medicare: Guide to the Best Resource' relatedtext='You may also be interested in:']

Another hidden cost to consider is the possibility of mis-selling. Over the years, there have been numerous cases of banks and credit card companies mis-selling PPI to customers who do not actually need the coverage. This has resulted in customers paying for insurance that they cannot use or that provides little to no benefit.

Furthermore, card protection insurance is often not fully explained to customers at the time of purchase. The terms and conditions, including the limitations and exclusions, may be buried in fine print or not disclosed at all. This lack of transparency can lead to misunderstandings and dissatisfaction when it comes to making a claim.

In conclusion, before purchasing card protection insurance, it is crucial to carefully consider the hidden costs that may come with it. This includes understanding the premiums, exclusions, and limitations of the insurance policy. Being well-informed will help consumers make an educated decision about whether card protection insurance is truly worth the investment.

Alternatives to Card Protection Insurance

When it comes to protecting our credit cards and personal information, opting for alternatives to card protection insurance can be a wise move. While card protection insurance may offer some benefits, such as coverage for fraudulent transactions and lost or stolen cards, it's important to consider other options that may be more cost-effective and provide similar protection.

One alternative to card protection insurance is utilizing the security features offered by your credit card issuer. Many credit card companies have robust fraud detection systems in place that monitor your account for any suspicious activity. This can provide you with an added layer of security without the need for an additional insurance policy.

Another alternative is to closely monitor your credit card statements and regularly check your credit reports. By reviewing your statements and credit reports, you can quickly identify any unauthorized transactions or potential signs of identity theft. This proactive approach allows you to take immediate action and minimize the potential damage.

Additionally, some financial institutions offer identity theft protection services that go beyond what card protection insurance typically covers. These services may include credit monitoring, identity theft resolution assistance, and reimbursement for certain expenses associated with identity theft.

In conclusion, while card protection insurance may offer a level of convenience and safety, exploring alternatives can provide similar protection at a potentially lower cost. Utilizing security features provided by your credit card issuer, monitoring your credit card statements and credit reports, and considering identity theft protection services are all viable options to safeguard your credit cards and personal information. Remember to assess your specific needs and evaluate the benefits and costs of each alternative before making a decision.

Understanding the Risks: Is Card Protection Insurance Worth It?

Card protection insurance, also known as credit card insurance, is a service offered by financial institutions to provide protection against potential risks associated with credit card usage. This type of insurance typically covers fraudulent transactions, identity theft, and loss or theft of the card.

The question arises: is card protection insurance really worth it? The answer depends on various factors and individual circumstances. It is important to consider the potential risks one might face and evaluate the cost-benefit ratio of having this type of insurance.

While card protection insurance offers peace of mind and financial security, it is crucial to carefully review the terms and conditions before making a decision. Some insurance policies have limitations and exclusions that may not provide full coverage for certain situations. It is essential to understand the extent of the protection provided and the potential cost of the insurance premiums.

Moreover, it is important to take into account other existing protections that may already be in place, such as the Fair Credit Billing Act, which provides some level of protection against fraudulent charges. Additionally, credit card companies often offer their own fraud protection measures and allow customers to dispute unauthorized transactions.

In conclusion, understanding the risks associated with credit card usage and evaluating the potential benefits and limitations of card protection insurance is essential. It is recommended to carefully read the terms and conditions, compare different insurance policies, and assess individual needs and circumstances before deciding whether card protection insurance is worth it.

How to Protect Your Cards Without Card Protection Insurance

Card protection insurance is often touted as a necessary measure to safeguard your financial security. However, there are alternative ways to protect your cards without relying on this type of insurance.

1. Regularly Monitor Your Accounts

One of the most effective ways to protect your cards is to regularly monitor your bank and credit card accounts. By reviewing your transactions regularly, you can quickly identify any unauthorized activity and report it to your bank or credit card provider.

2. Set Up Alerts

Another helpful tool for card protection is setting up alerts on your accounts. Many banks and credit card companies offer alerts via email or mobile notifications for various activities, such as large purchases or changes in account information. This way, you can stay informed and quickly respond to any suspicious activity.

[aib_post_related url='https://towla24.com/who-qualifies-for-aarp/' title='Who Qualifies for AARP? Find Out Now!' relatedtext='You may also be interested in:']

3. Create Strong, Unique Passwords

Protecting your online accounts with strong, unique passwords is another crucial step in card protection. Avoid using easily guessable passwords such as birth dates or common words. Instead, use a combination of uppercase and lowercase letters, numbers, and special characters. Additionally, ensure you use different passwords for each account to minimize the risk of multiple accounts being compromised.

By implementing these practical steps, you can significantly reduce the risk of financial fraud and protect your cards without relying on card protection insurance.

Leave a Reply